Steps to your online claim

Taxation

Your claim will be taxed at the rate required by Australian tax laws. It will be calculated based on your gross weekly wages and the Australian Taxation Office’s weekly tax table.

You can choose to claim the tax-free threshold when you submit your claim. Find out more about the tax-free threshold here.

What you'll need before you claim

What you'll need before your claim:

- your tax file number

- your bank account details

- your service updated by your employer (if you're leaving the industry)

- a copy of your photo ID (for example, your drivers license or passport)

- all required supporting documents (more details below)

If you're a PAYG employee, you must provide one of the following supporting documents:

- a recent payslip OR

- a letter from your employer (on company letterhead) stating that they have not paid you for this long service leave claim

If you're a labour-only subcontractor you must provide:

- a tax invoice that shows your hourly rate of pay

If you're making a leaving the industry/cessation of employment claim you may need to provide additional evidence:

Reason for leaving the industry:

- Approved early retirement scheme - you must provide proof of your employer-devised early retirement scheme approved by the Commissioner of Taxation.

- Genuine redundancy - you must provide a copy of your separation certificate citing redundancy as the reason for ending your employment.

- Invalidity - you must provide certification from two qualified medical practitioners stating physical or mental incapacity has stopped you from continuing in the industry, forcing you to leave your employment early (before age 65).

- Standard (where none of the above apply) - no additional proof required.

Please note: it may take longer for your claim to be paid if you don't supply the correct documentation.

We may also need more documentation from you to process your claim. We'll contact you if we need you to provide more information.

Login and start your claim

Getting started

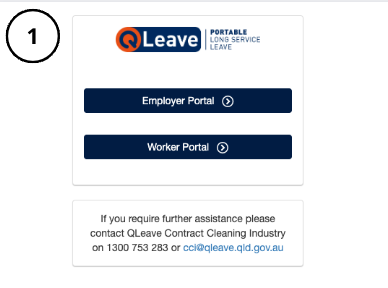

- Go to the online portal and select Worker Portal.

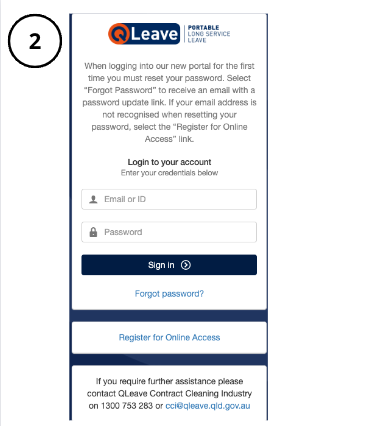

- Enter your email address OR QLeave worker number and password and then click Sign in. If you're not sure what your password is, click Forgot password? to reset your password and login.

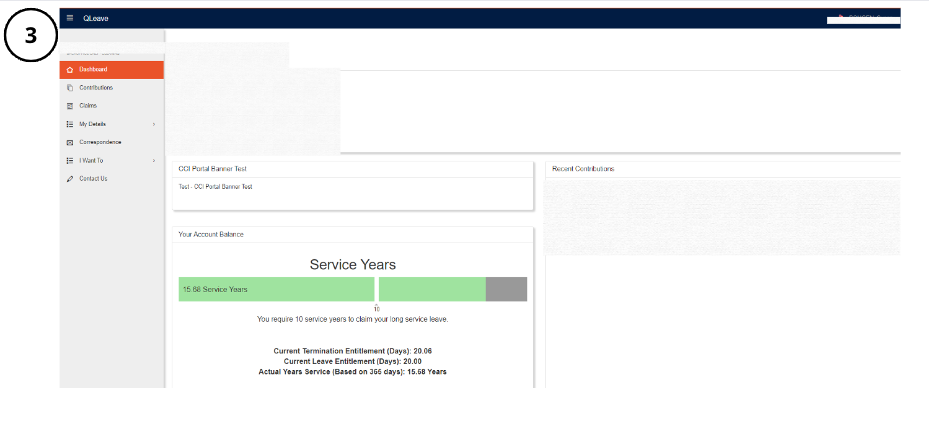

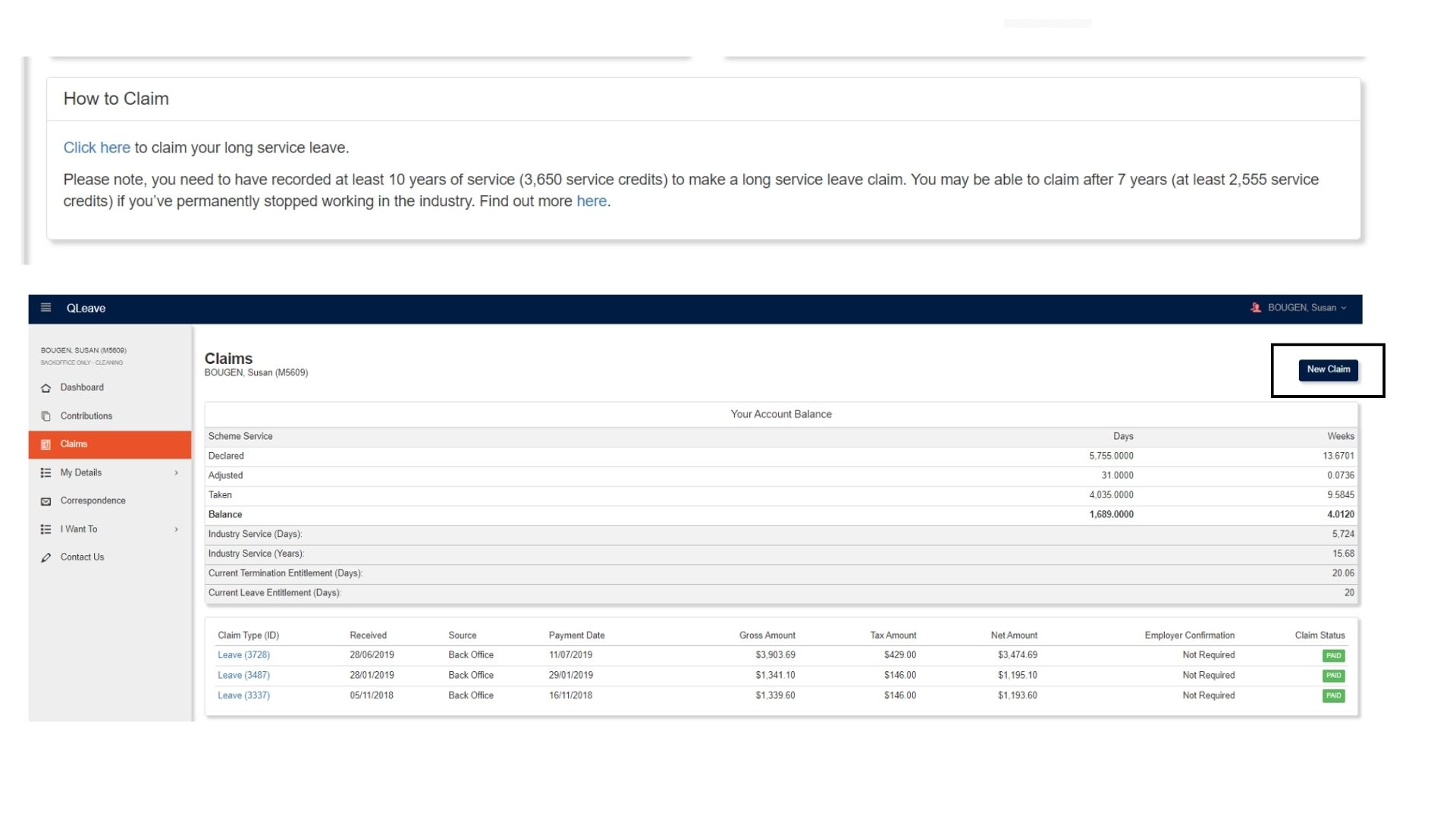

Please note: if this is your first time logging in to the portal, you will need to register for online access first. Click here for instructions. - When you first login, you'll see your dashboard. To make a claim, either select Claims from the left-hand menu or scroll down the page and click the link provided in the How to claim section. Then select New Claim in the top right corner.

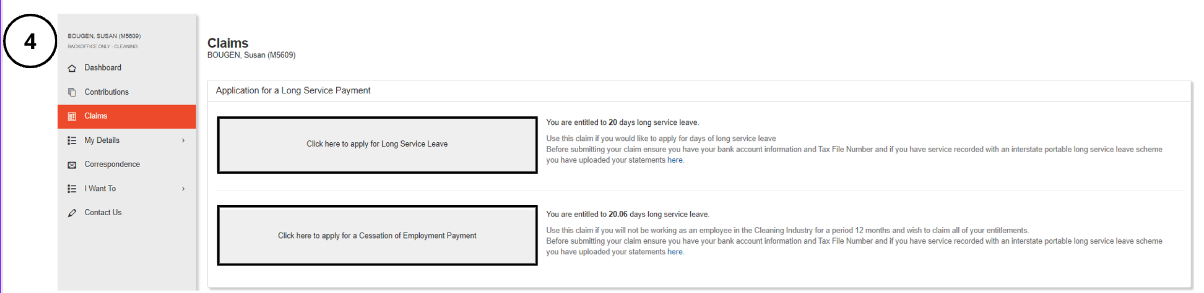

- Select your claim type

To start your claim you will first need to select the type of claim you want to make from the options available:

- Taking leave (long service leave): you can make this type of claim if you have at least 3,650 service credits available (equivalent of 10 years in the scheme).

You may also be able to make this type of claim if you've worked in the contract cleaning industry in New South Wales or the Australian Capital Territory and have recorded service with either NSW Long Service Corporation or ACT Leave.

To start a taking leave claim, select Click here to apply for Long Service Leave. - Leaving the industry (Cessation of Employment Payment): you can make this type of claim if you've permanently stopped working in the contract cleaning industry and have at least 2,555 service credits (equivalent of 7 years in the scheme). Your QLeave registration will be cancelled once your leaving the industry claim has been paid, so if you return to the industry later you will have to start building your service credits again from zero.

To start a leaving the industry claim, select Click here to apply for a Cessation of Employment Payment.

See the next steps to making a taking leave or leaving the industry claim below.

Are you taking a break? Click here

Follow the steps below to lodge your taking leave claim.

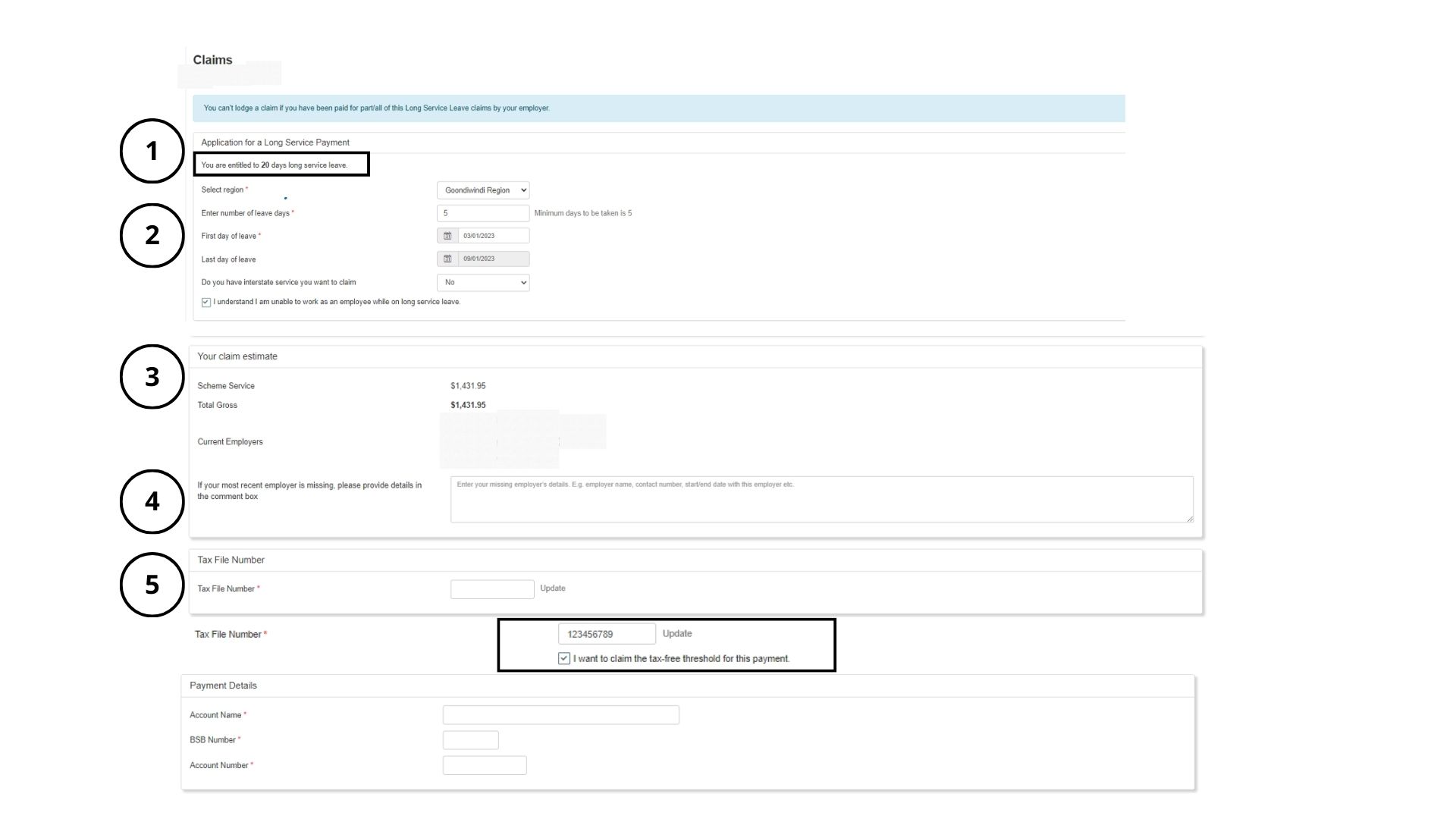

1. You'll see how many long service leave days you're entitled to.

2. Fill out your leave details:

- Select your region from the dropdown menu (e.g. Goondiwindi Region)

- Enter your number of leave days (you must have at least five days available to make a claim unless you have stopped working in the industry).

- Enter your first and last day of leave

- Select yes or no if you have interstate service you want to claim. Select yes if you've performed cleaning work in New South Wales or the ACT, as it may count towards your overall long service leave benefit.

- Click the checkbox to understand you cannot work as an employee while on long service leave.

3. You'll see your claim estimate.

Please note: this amount is an estimate of how much you’ll be paid for your claim. The final amount will be advised once your claim has been processed and paid.

4. If your most recent employer is not listed, enter their missing details, including employer name, contact number, start/end date with this employer.

5. Enter your tax file number and payment details in the boxes.

When you enter your tax file number, you can choose to select the tax-free threshold for your claim payment. If you earn under the threshold, selecting yes means you might not pay tax on your claim. You can find more information on the Australian Taxation Office website.

Please double-check that your payment details are correct to ensure your claim is paid into the right account. We may not be able to recover payments made to incorrect accounts.

6. Upload your supporting documentation. You must provide supporting documents, which is either:

- a payslip OR

- a letter from your employer (on company letterhead) stating that they have not paid you for this long service leave claim.

If you're a labour only subcontractor and can't supply one of the above, please provide:

- a tax invoice that shows your hourly rate of pay.

You must also provide a copy of your photo ID. For example, your drivers license or passport.

Please note: you must provide the correct supporting documentation when you lodge your long service leave claim. If you don't provide the necessary documentation, your claim will be declined and you'll need to submit a new one.

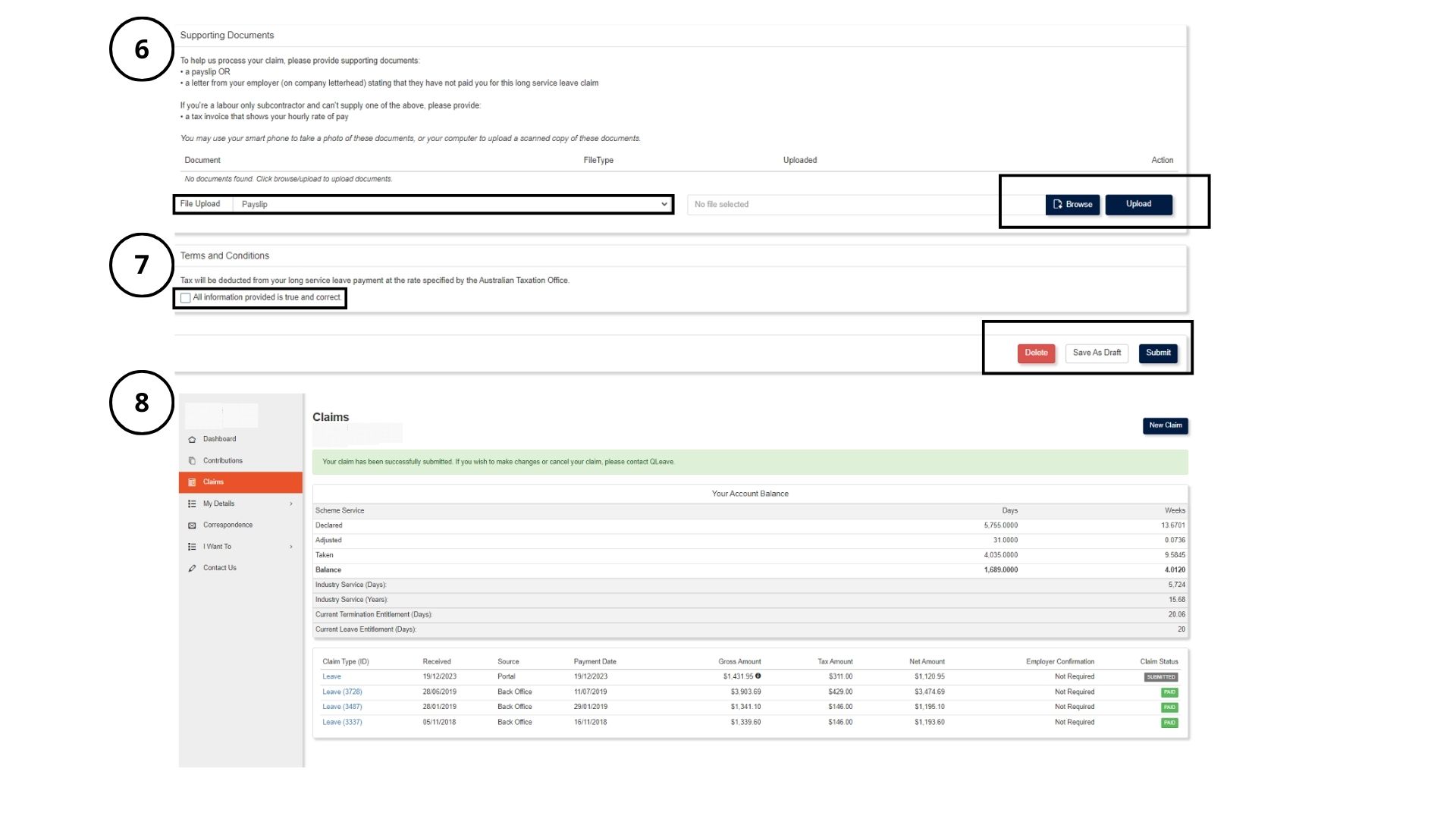

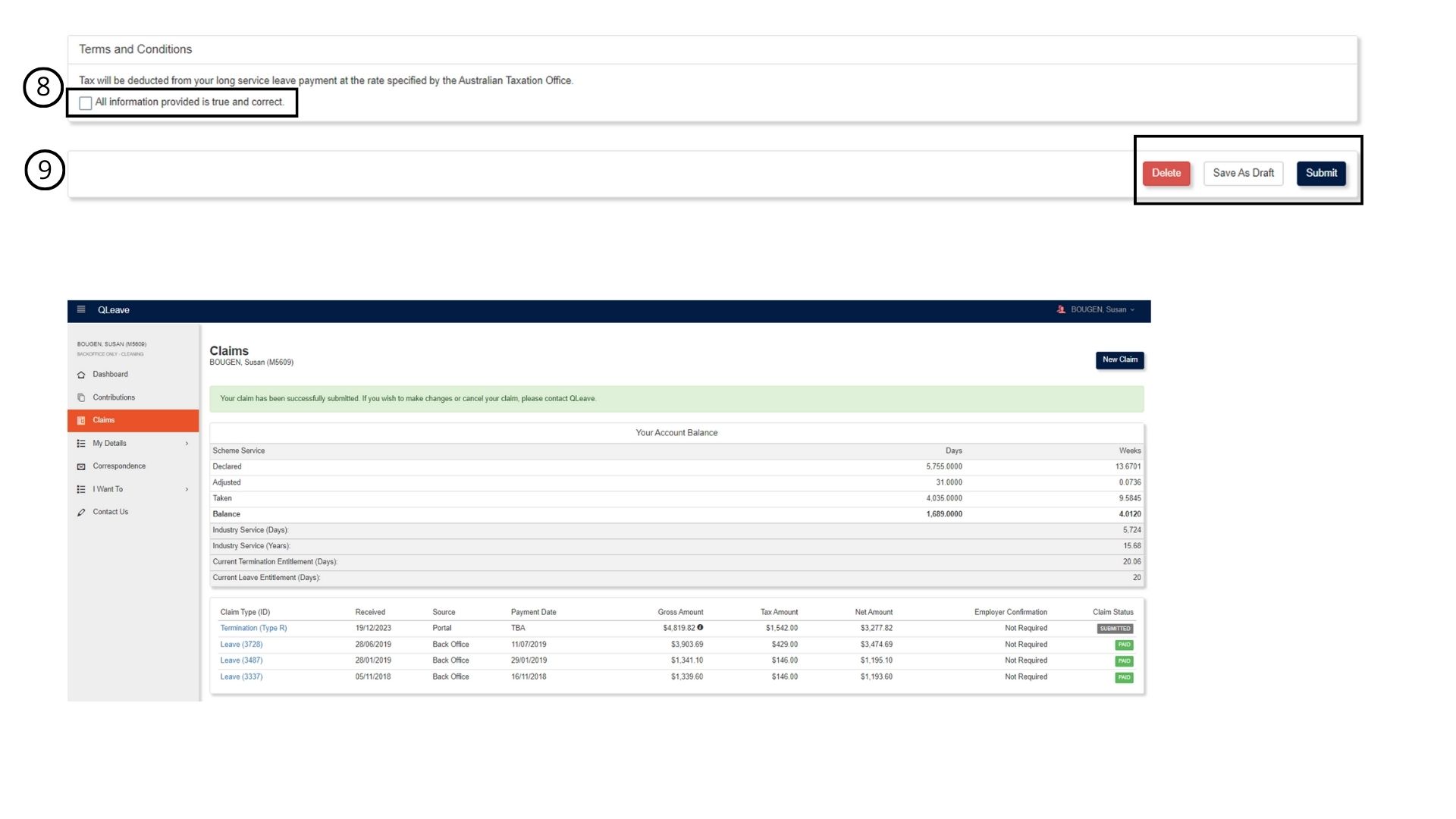

7. Click the checkbox if all the documentation provided is true and correct. It states here tax will be deducted from your long service leave claim payment at the rate specified by the Australian Taxation Office.

8. Click submit

Are you leaving the industry? Click here

Follow steps to lodge your leaving the industry claim (Cessation of Employment Payment)

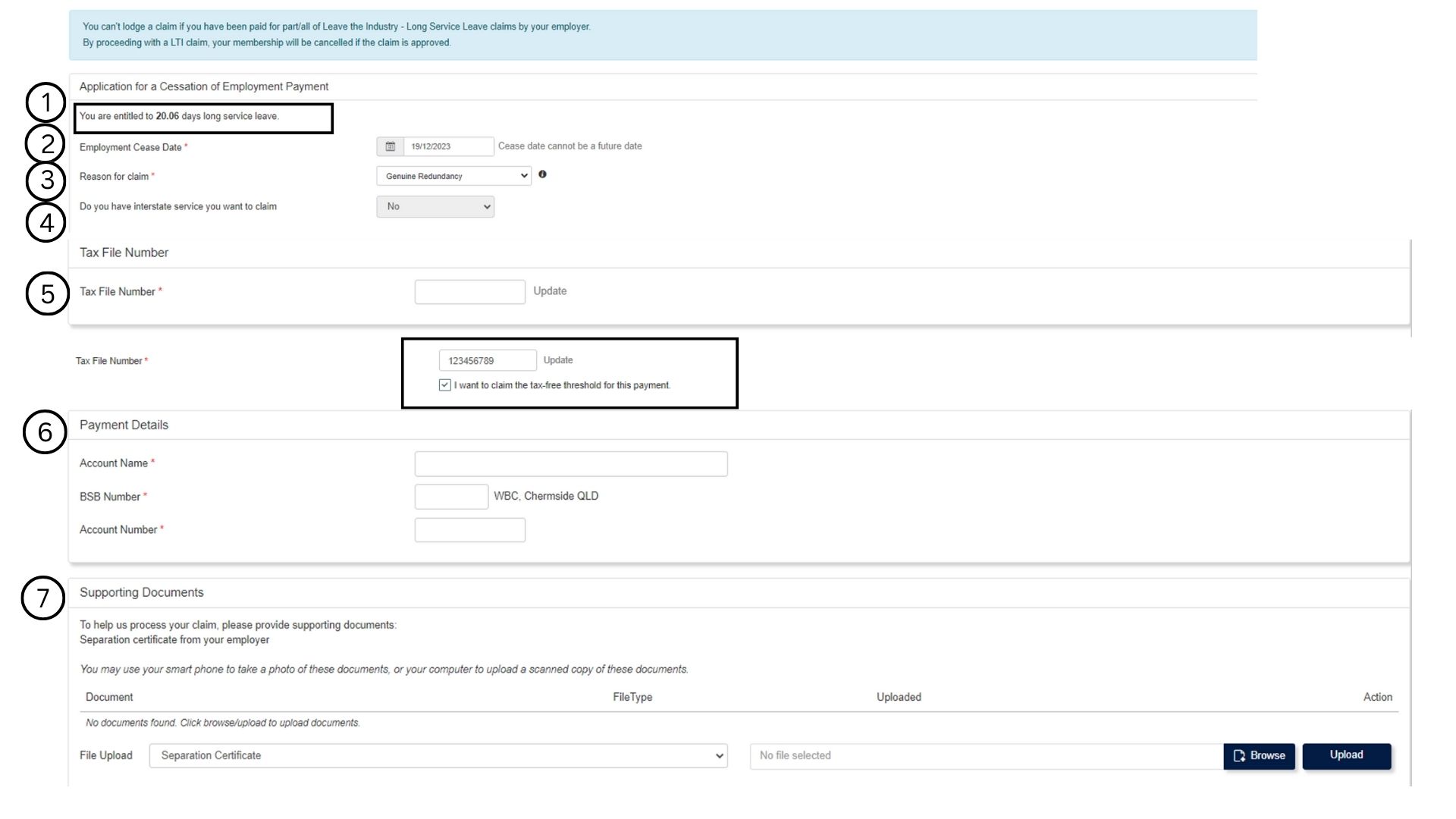

1. You'll see how many long service leave days you're entitled to.

2. Enter the date you finished working in the industry (cease date cannot be a future date).

3. Select the reason you're leaving the industry from the dropdown menu, you can choose from:

- Approved early retirement scheme

- Genuine redundancy

- Invalidity

- Standard (where none of the above apply)

4. Select yes or no if you have interstate service to collect. Select yes if you've performed cleaning work in New South Wales or the ACT, as it may count towards your overall long service leave benefit.

5. Enter your tax file number. When you enter your tax file number, you can choose to select the tax-free threshold for your claim payment. If you earn under the threshold, selecting yes means you might not pay tax on your claim. You can find more information on the Australian Taxation Office website.

6. Enter your payment details.

Please double-check that your payment details are correct to ensure your claim is paid into the right account. We may not be able to recover payments made to incorrect accounts.

7. Upload your supporting documentation to provide reason for leaving the industry. The required documentation includes:

- Approved early retirement scheme - you must provide proof of your employer-devised early retirement scheme approved by the Commissioner of Taxation.

- Genuine redundancy - you must provide a copy of your separation certificate citing redundancy as the reason for ending your employment.

- Invalidity - you must provide certification from two qualified medical practitioners stating physical or mental incapacity has stopped you from continuing in the industry, forcing you to leave your employment early (before age 65).

- Standard (where none of the above apply) - no additional proof required.

You must also provide a copy of your photo ID. For example, your driver licence or passport.

You can use your smart phone to take a photo of the documentation or your computer to upload a scanned copy.

Please note: you must provide the correct supporting documentation when you lodge your long service leave claim. If you don't provide the necessary documentation, your claim will be declined and you'll need to submit a new one.

8. Click the box if all the documentation provided is true and correct. It states here tax will be deducted from your long service leave claim payment at the rate specified by the Australian Taxation Office.

9. Click submit

What happens next?

- When your claim is submitted, you'll receive an email from us confirming that we've received it.

- It may take us longer to finalise your claim if you haven't provided the correct details or supporting documents when submitting your claim. We'll contact you if we need you to provide more details.

- Your claim may also be delayed if we need information from your employer or an interstate scheme.

- You'll receive an email from us once we've approved your claim, and again once the claim has been paid.

- You'll receive a pay advice with the amount you've been paid and the amount of tax that has been deducted. You won't receive a PAYG payment summary, so if you want to check the details of the tax applied to your claim you can login to your MyGov account.

- You can also check the status of your claim at any time by logging into the worker portal.

- If your claim is declined, we'll contact you to let you know why.

- Once your claim has been approved and finalised, your service balance will be adjusted. You'll be able to check your adjusted balance in the portal. If you made a leaving the industry claim, your QLeave registration will be cancelled.