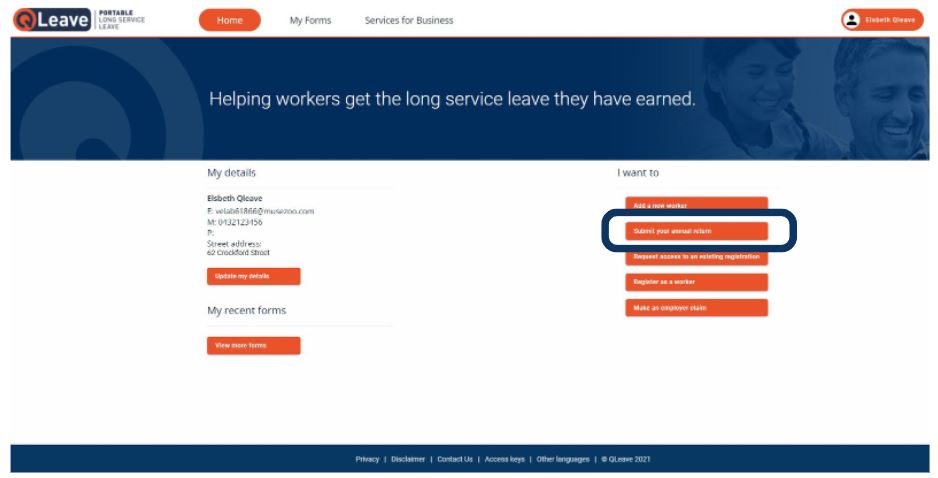

I want to...

Worker Service Returns

No workers or ceased trading

If you didn't engage eligible workers, or have ceased trading, in the last financial year, you'll need to let us know by 31 July. You can do this either by completing the Employer Advice - Nil Return or Ceased Trading form and returning it to members@qleave.qld.gov.au, or by advising us in the online portal.

If you intend to submit a Worker Service Return you don't need to submit a nil return or ceased trading form.

How to advise us if you didn't engage eligible workers this financial year

Employers can complete the employer advice online or by completing the Nil Return or Ceased Trading form.

Steps to submit a nil return online

Log in

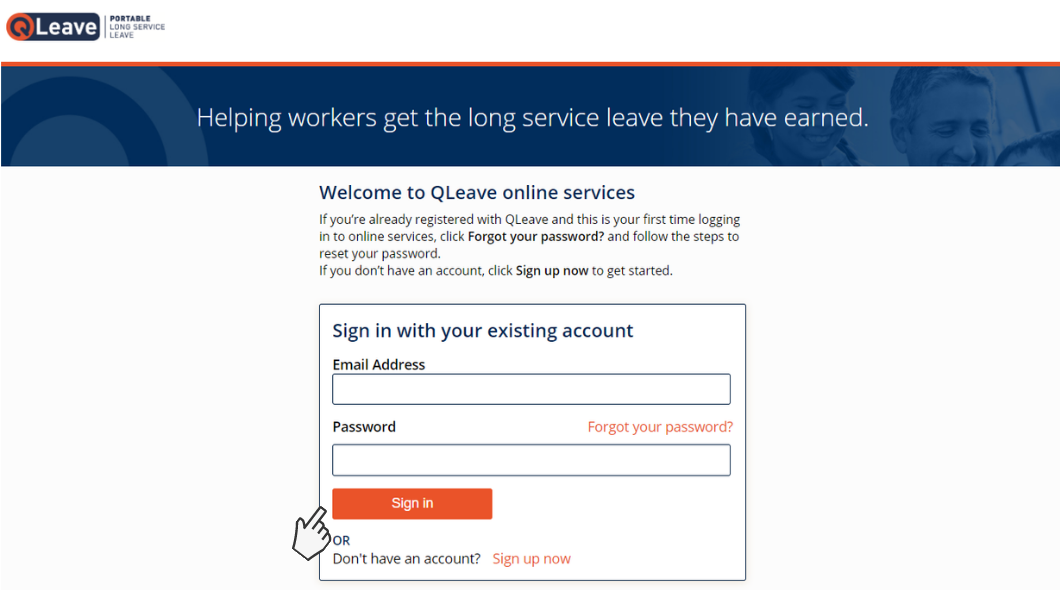

1. Go to the online portal.

2. Enter your email address and password and click Sign in.

3. If you don’t know your password, click Forgot your password? to reset it. A verification code will be emailed to you. Click here for help resetting your password.

4. Once you've logged in, you'll be taken to the online services home page. From the I want to menu on the right-hand side, select Submit your annual return.

Submit a nil return

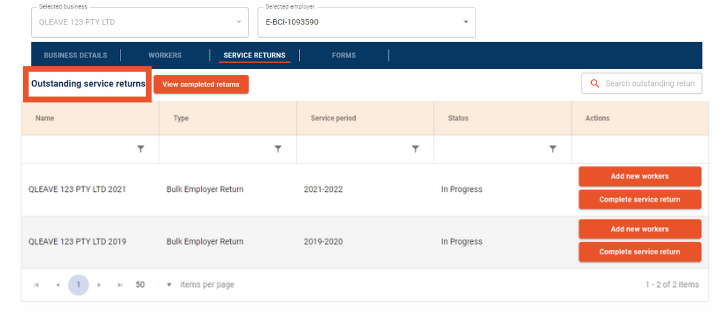

1. In the service returns tab, you'll automatically see your outstanding returns, these are listed by financial year. Click complete service return in the box with the relevant financial year.

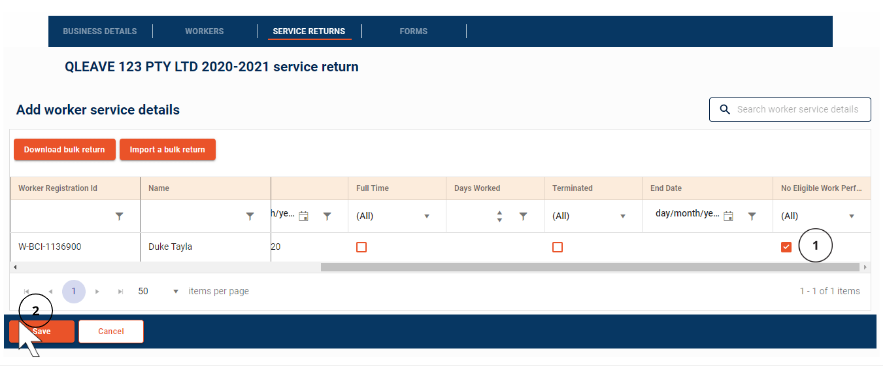

2. Once on the returns page, scroll to the end of the far right of the service return table and check the box under no eligible work performed then click save. This will notify us that none of your eligible registered workers performed eligible work for you for this financial year.

If you engaged any workers during the financial year, you will need to complete a worker service return. Click here for instructions.

Please note, a maximum of 10 workers are displayed on each page of the return. If you have more than 10 workers, you will need to click through each page and select no eligible work performed for your workers on each page.

3. After you've saved your return, the buttons will change and you will click submit all workers.

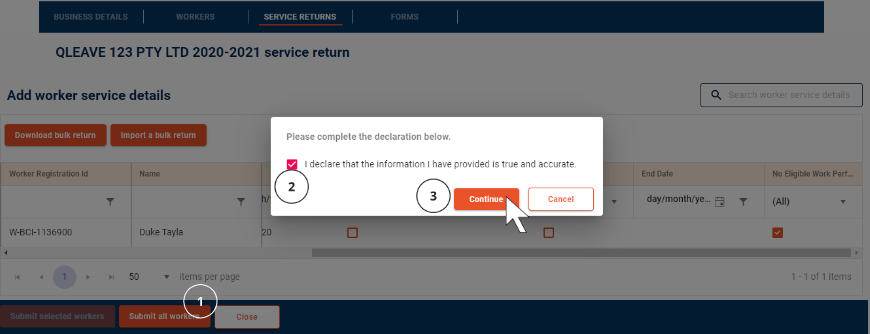

4. Check the box in the declaration.

5. Click continue. Your nil return will now be sent to QLeave and can view it under the complete service returns tab. We'll now process this as a nil return for the current financial year.

How to advise us if you've ceased trading

If you're no longer engaging eligible workers, contact us to let us know you would like to cancel your QLeave registration. You'll need to submit a worker service return for all terminated workers up to, and including their last day of work, before we can cancel your registration. After receiving the request to cancel your registration, we'll contact you to confirm details.