Steps to your online claim

Important note regarding claim payments

Long service leave payments are made when the claim is approved. If your leave starts more than 14 days from when you lodged your claim, we will pay you within ten days of this leave start date date.

Maximum wage

A maximum wage rate applies. Find the current rate here.

Taxation

Your claim will be taxed at the rate required by Australian tax laws. It will be calculated based on your gross weekly wages and the Australian Taxation Office’s weekly tax table.

You can choose to claim the tax-free threshold when you submit your claim. Find out more about the tax-free threshold here.

Watch our video guides for help making your claim:

What you'll need before you claim

What you'll need before you claim for all claim types

- Your tax file number

- Your service updated by your employer (if you are lodging a leaving the industry claim)

- Proof of rate of pay from the employer who last recorded service on your QLeave registration (see examples below)

- A copy of your photo ID (for example, your drivers license or passport)

If you are a labour-only subcontractor you'll also need:

- Your ABN

- The ABN of the company you are invoicing

Please make sure you provide the correct supporting documentation needed for us to process your claim. If you don't provide the correct supporting documentation, it may take longer for your claim to be paid.

Proof of rate of pay for PAYG employees is:

- a payslip or

- a letter from your employer (on company letterhead) stating your ordinary working hours, hourly rate, allowances (specified separately) and type of work performed.

Proof of rate of pay for labour-only subcontractors is:

- a tax invoice that shows your hourly rate of pay or

- your most recent tax invoices for a period of three months, if paid on a piecework rate or

- a letter from your employer (on company letterhead) stating your ordinary working hours, hourly rate, allowances (specified separately) and type of work performed.

Proof of rate of pay for working directors is:

- a copy of your income tax return for the two most recent financial years.

Additional evidence required for leaving the industry claims

Reason for leaving the industry:

- Approved early retirement scheme - proof of your employer-devised early retirement scheme approved by the Commissioner of Taxation.

- Genuine redundancy - a copy of your separation certificate citing redundancy as the reason for ending your employment.

- Invalidity - certification from two qualified medical practitioners stating physical or mental incapacity has stopped you from continuing in the industry, forcing you to leave your employment early (before age 65).

- Standard (where none of the above apply) - no additional proof required.

Please note: you must provide the correct supporting documentation when you lodge your long service leave claim. If you don't provide the necessary documentation, we won't progress your claim and you'll need to submit a new one.

You can find more information about the documentation you'll need to submit your claim below.

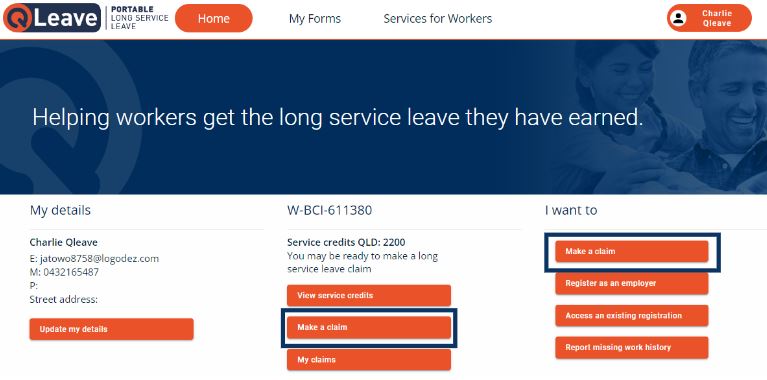

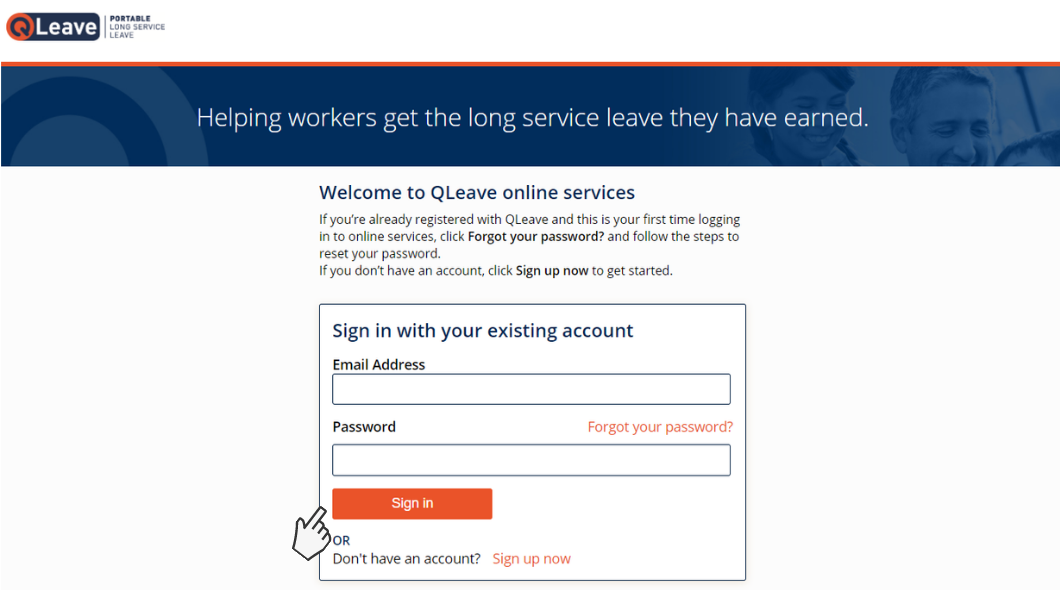

Log in and start your claim

GETTING STARTED

- Go to the Employer and Worker Portal.

- Enter your email address and password and click Sign in.

- If you don't know your password, click Forgot your password? and a verification code will be emailed to you. Once your email address is verified you can reset your password to log in.

- Click Make a claim from either the service credits menu or the I want to menu.

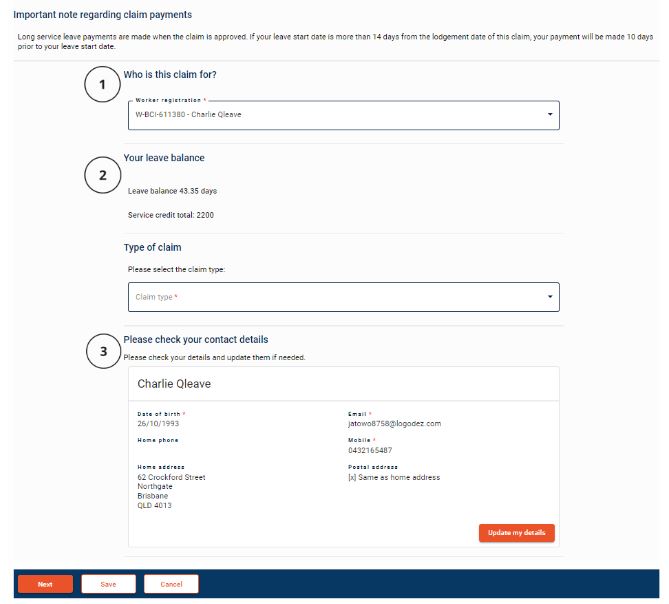

SELECT YOUR CLAIM TYPE

- If you have more than one registration, check that the correct registration is selected. This page shows your long service leave balance in days. Please note: you must have at least 5 days available to make a claim unless you have stopped working in the industry.

- Select either:

- Taking Leave for a 10 year long service leave claim (you need at least 2,200 service credits for this type of claim) OR

- Leaving the Industry. If you have permanently stopped working in the building and construction industry. You need a minimum of 1,155 service credits and to have been in the scheme for seven or more years to make this type of claim.

Please note: if you make a leaving the industry claim, your QLeave registration will be cancelled. Further information on claim types and reasons for leaving the industry can be found in the more information section below.

- Check your contact details are correct and update them if needed. Click update my details, enter the correct details and then save changes.

- Click next to continue.

Select the appropriate option below to see the next steps for making a taking leave or leaving the industry claim.

Are you taking a break? Click here

Follow the steps below to lodge your taking leave claim.

Please note: if you need to leave the form, click save to make sure you don't lose your progress. You can log back into online services later and open the saved form where you see it listed under my recent forms.

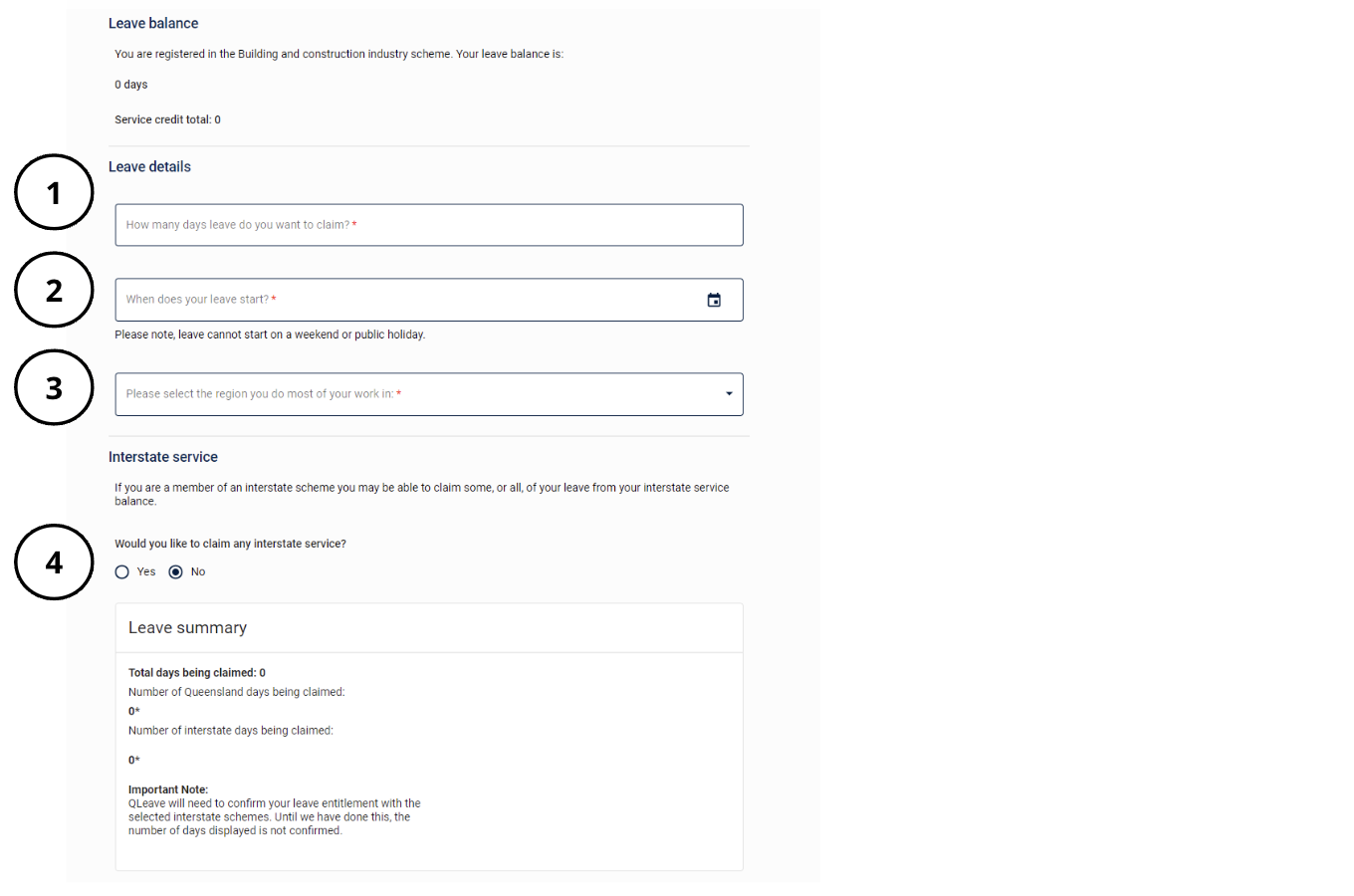

Your long service leave entitlement is shown in days at the top of the form.

- Enter the number of days leave you want to claim. You must have at least five days available to make a claim unless you have stopped working in the industry.

- Select the date you’d like your leave to start. Please note:

- your leave can’t start on a weekend or public holiday. Public holidays will be paid to you provided you’re on long service leave (paid by QLeave) on the working days immediately before and after the public holiday to receive the additional payment.

- If you’re taking a period of leave that spans a financial year and you want full payment before the leave commences, the full amount will appear on your payment summary for the year in which it is paid. If you’re taking a period of leave that spans a financial year and you want to split the payment over the two financial years (and receive two separate payment summaries), you’ll need to submit two claims. - Select the region you do most of your work in.

- If you have a registration with an interstate scheme you may be able to claim some, or all, of your leave from your interstate service balance. If you’d like to claim interstate service, select yes and then select the interstate scheme/s you want to claim against.

Enter your registration number and your current leave balance (if known) for the relevant interstate scheme/s.

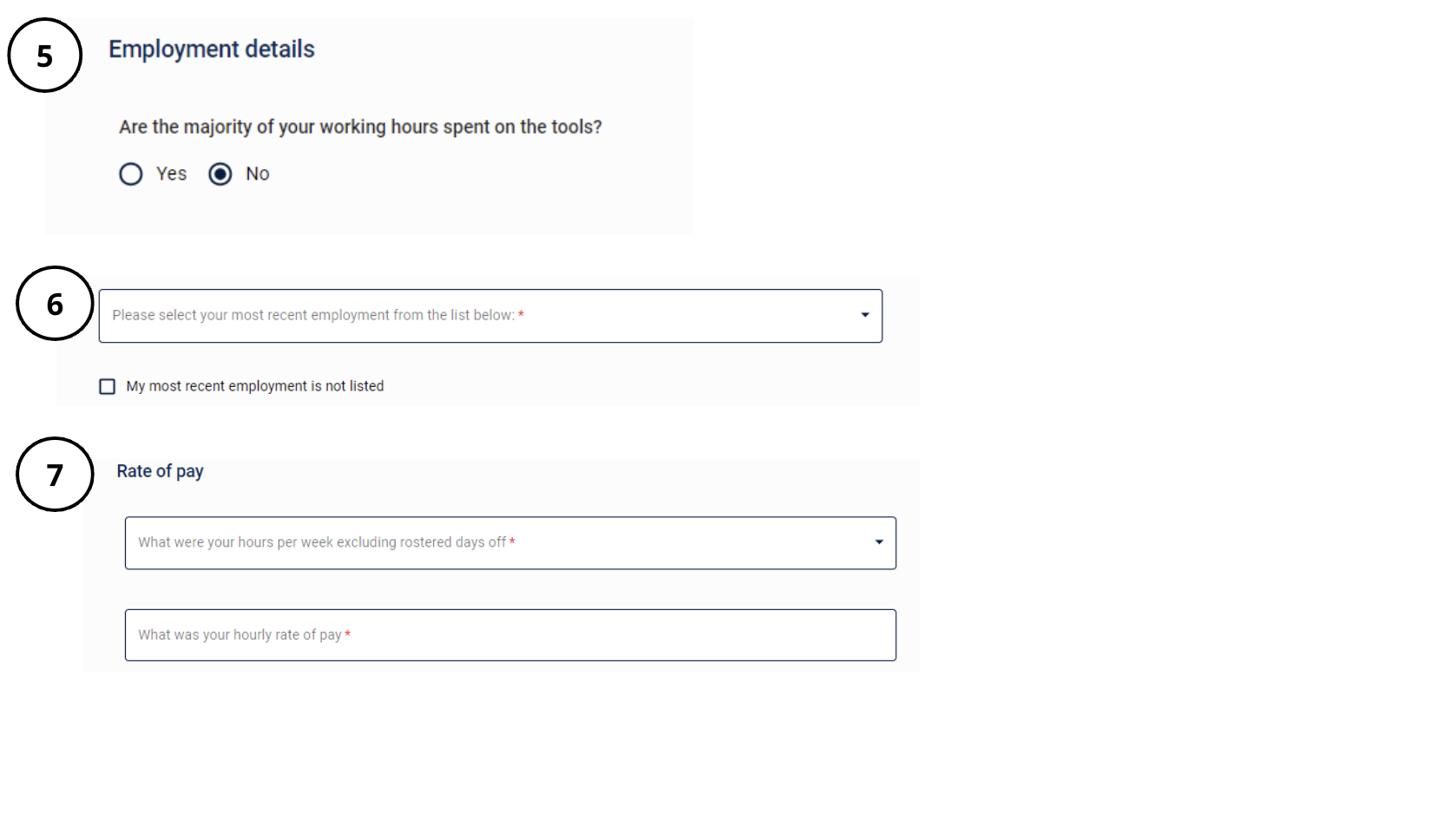

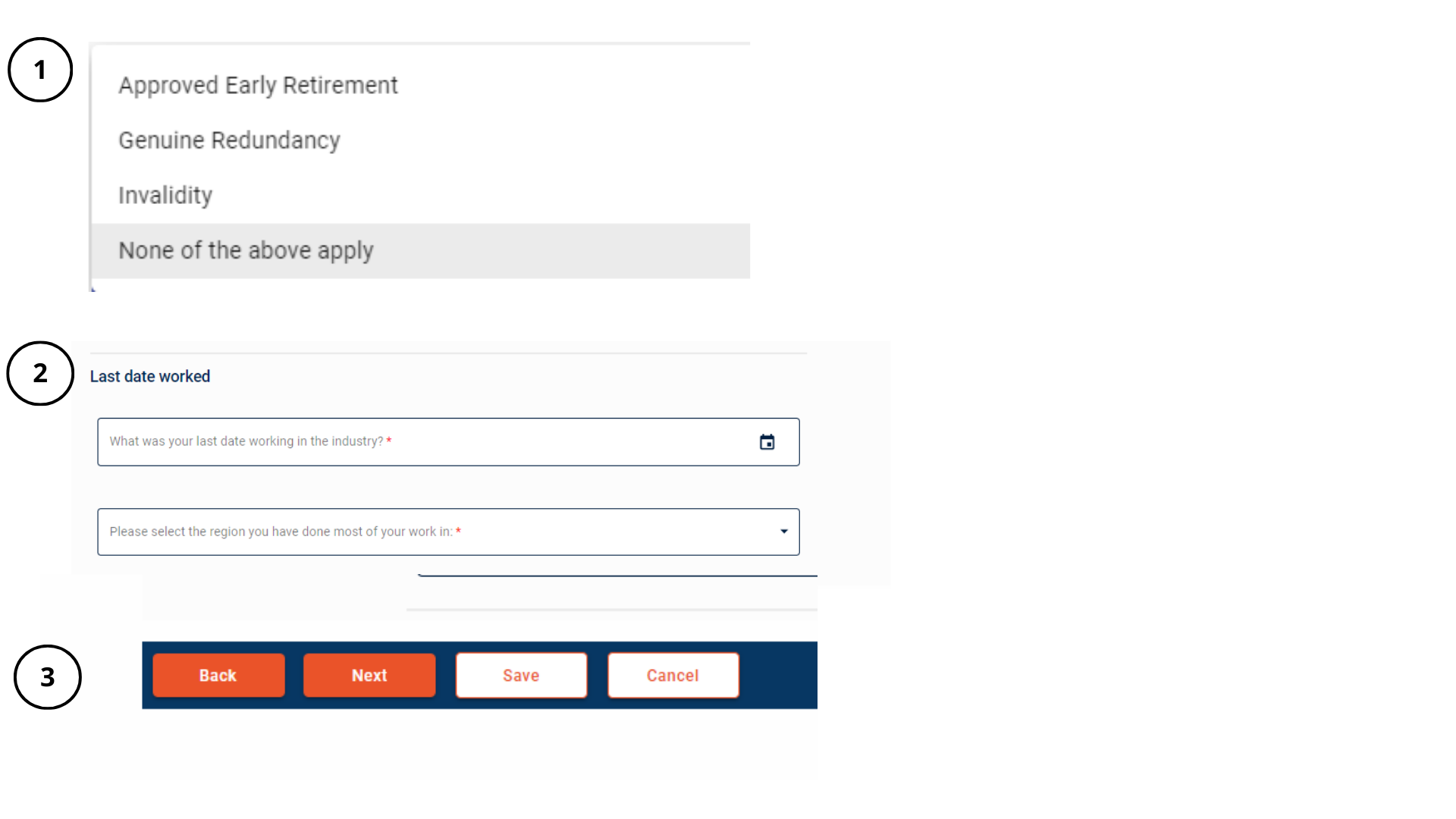

Any interstate service used is calculated in accordance with the policies of those schemes. Details for interstate schemes can be found here. - If you spend the majority of your working hours on the tools, select yes. Otherwise, you must select no.

- Select your most recent employer from the list. If your most recent employer is not listed, select my most recent employment is not listed and search for your most recent employer by entering their name, ABN or QLeave ID. If you can’t find your employer using the search, you can enter their details manually or find help via the link to the Missing Work History information page.

- Enter the number of ordinary hours you work per week and your hourly rate of pay.

- If you’re currently receiving any allowances as part of your wage, select yes.

- Enter the amount you’re paid per week for the allowance/s you receive.

- Click next to continue.

Are you leaving the building and construction industry? Click here

You are making a leaving the industry claim

- You must have permanently stopped working in the building and construction industry to make this claim.

- You need a minimum of 1,155 service credits AND to have been in the scheme for seven or more years.

- Your QLeave worker registration will be cancelled after the claim has been processed.

- Reasons for ending employment:

- Bona fide redundancy – the Australian Taxation Office has described this as:

- the employee must have been dismissed from a job, not having left voluntarily

- the employee must have been made redundant (where the employee’s particular work has ceased or tapered off or the workplace has been relocated) and

- the dismissal must have been made before the employee has to retire (for example, before age 65, or before a set period of service).

- Invalidity – when physical or mental incapacity stops an employee from continuing in their present line of work, forcing them to leave employment early (and in any event before age 65). Invalidity needs to be certified by two qualified medical practitioners.

- Bona fide redundancy – the Australian Taxation Office has described this as:

Follow the steps below to lodge your leaving the industry claim

Please note: if you need to leave the form, click save to make sure you don't lose your progress. You can log back into online services later and open the saved form where you see it listed under my recent forms.

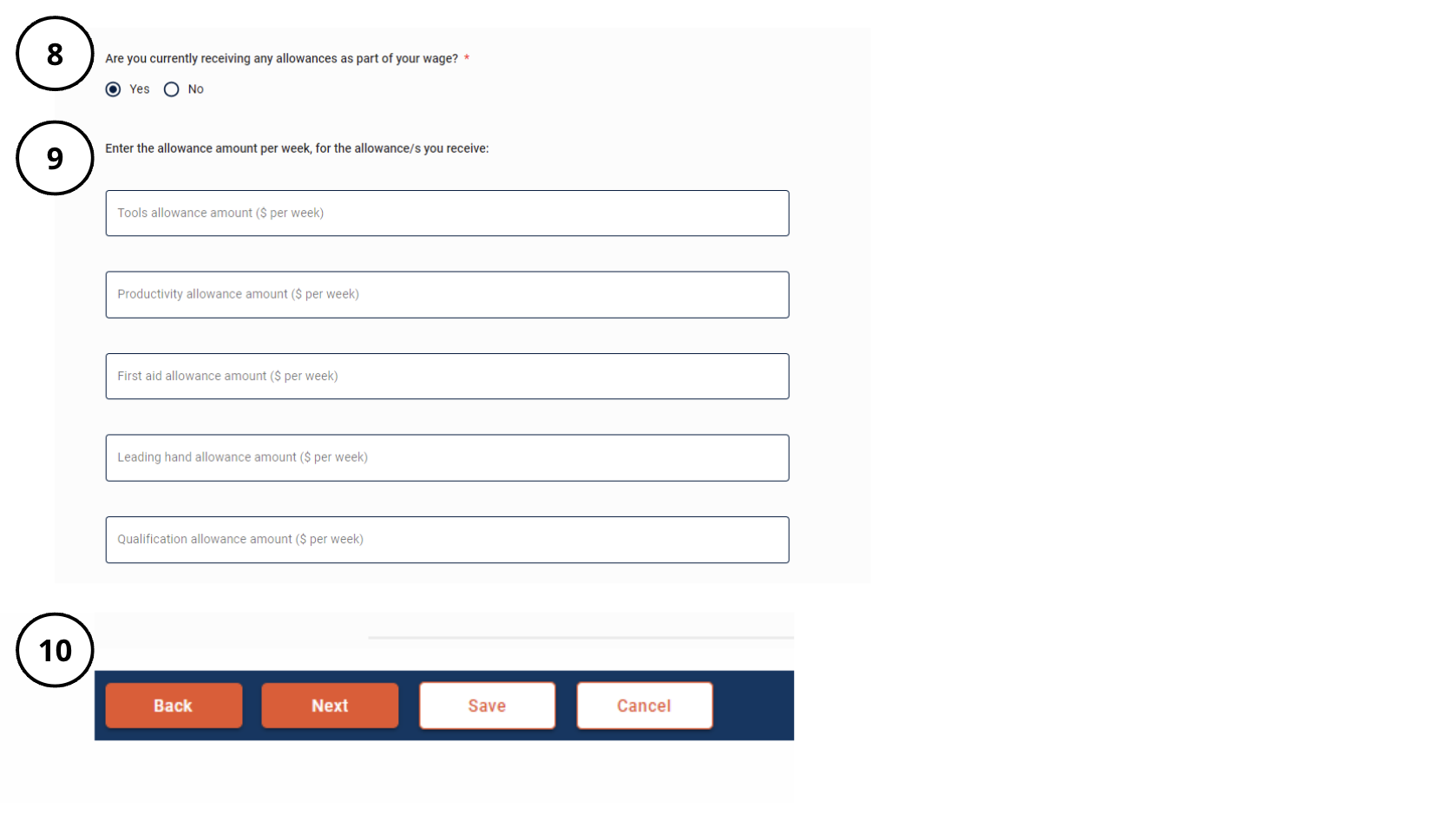

1. Select an option for why you're leaving the industry from the dropdown menu:

- Approved early retirement scheme - proof of your employer-devised early retirement scheme approved by the Commissioner of Taxation.

- Genuine Redundancy - the employee must have been made redundant (where the employee’s particular work has ceased or tapered off or the workplace has been relocated).

- Invalidity - certification from two qualified medical practitioners stating physical or mental incapacity has stopped you from continuing in the industry, forcing you to leave your employment early (before age 65).

- Standard (where none of the above apply) - no additional proof required.

2. Select the last date you worked in the industry and the region at the bottom of the page.

3. Click next to continue.

Please note: you must provide the correct supporting documentation when you lodge your long service leave claim. You can find the other supporting documentation you'll need for your claim below. If you don't provide the necessary documentation, we won't progress your claim and you'll need to submit a new one.

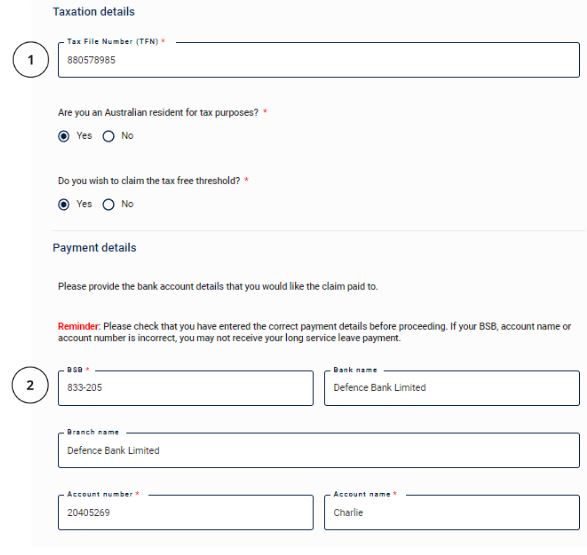

Taxation and payment details

TAXATION AND PAYMENT DETAILS

- Enter your tax file number and select either Yes or No to claiming the tax-free threshold. If you have not supplied a tax file number, tax will be deducted at the top tax rate plus the medicare levy. Otherwise, the tax will be deducted in accordance with the Pay as You Go Withholding Tax Tables supplied by the Australian Tax Office taking into account the information supplied. You can find out more here.

If you claim the tax-free threshold and your claim payment is higher than the tax-free threshold, tax will be applied to the difference between the threshold and your claim payment. Find out more about the tax-free threshold. - Claims are paid via Electronic Funds Transfer (EFT). Enter your BSB, bank name, account number and account name.

Please make sure that you’ve entered the correct payment details before proceeding. If any of the details you’ve provided are incorrect, your claim may be paid into the incorrect account and you may not receive your long service leave payment. - Click next to continue.

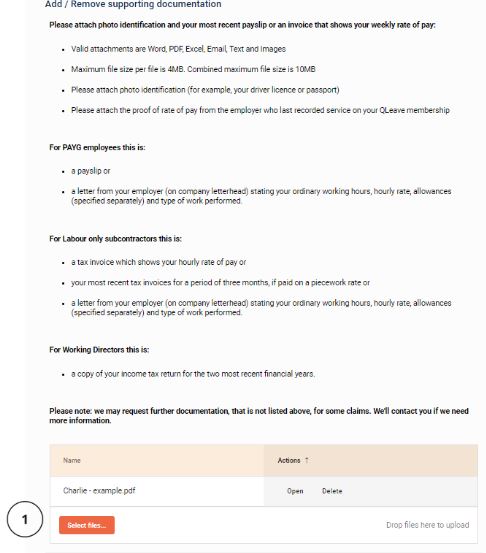

Add supporting documentation and submit your claim

SUPPORTING DOCUMENTATION

- You must attach proof of your rate of pay (e.g. a payslip or invoice) and a copy of your photo ID (e.g. your drivers license or passport).

Accepted forms of supporting documentation are explained at the start of this guide. - Click next to continue.

SUBMIT YOUR CLAIM

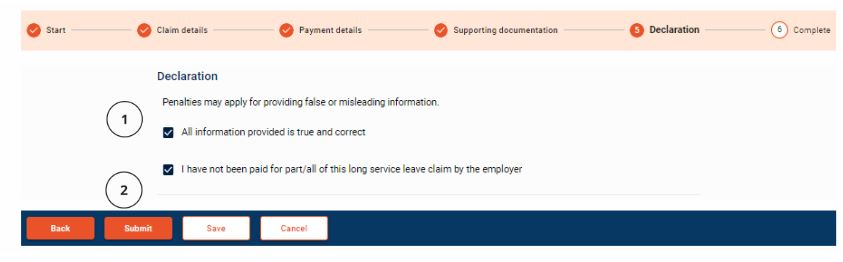

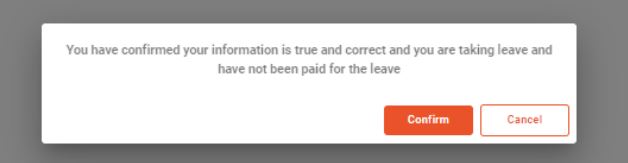

- Complete the declaration to confirm the information you’ve provided is true and correct.

- To finalise your claim, click Submit.

- After you click submit, the above pop-up will appear asking you to confirm that your information is true and correct, and that you are taking leave and have not been paid for the leave. Click Confirm to submit your claim to QLeave.

- If amendments are required, click Cancel to return to the previous page and update your information.

- After you submit your claim you'll see a copy of the form we’ve received and an on-screen confirmation that your claim has been submitted. Review the submission and if there’s anything you’d like to correct please contact us.

- You can check the status of your claim at any time by logging in to online services and viewing the claim form under my recent forms. When your claim has been approved the status will change from processing to completed.

Please note: you must provide the correct supporting documentation when you lodge your long service leave claim. If you don't provide the necessary documentation, we won't progress your claim and you'll need to submit a new one.

Once your claim has been processed, we’ll send you an email to let you know that your claim has been paid. You’ll receive a pay advice with the amount you have been paid and the amount of tax that has been taken out. You won’t receive a PAYG payment summary. For more information about your claim payment and how tax has been applied, you can login to your MyGov account and access your income statement.